I've Unlocked Intergenerational Wealth

Look, I’d like to set future generations of Merrimans up for a stress-free financial existence. Is that a crime? That we’re participating in a capitalist society for the benefit of a few is something I brushed off long ago because I want to buy a lake house and a jet ski.

I don’t have much interest in crypto-anything when it comes to building wealth. It’s fine if you’re into it, I’ve only lost a little respect for you - but it’s not for me. Utility cases haven’t been up to snuff. I prefer to participate in more *traditional* wealth building practices like wildly leveraged Robinhood speculation and betting Harold Varner III to win every major. I do, however, have a Serge Ibaka dunk from 5 years ago digitally entombed in my NBA topshot wallet available for a FRACTION of the purchase price if you’re interested. He’s gonna get hot, man. I promise.

Anyway, if you’re like me, you’re more comfortable creating intergenerational wealth to pass on to your kin at a slower pace. And boy do I have an opportunity. Call it a get-rich-Quik scheme. Quikrete. Concrete. Stay with me here.

Whether you believe it’s due to natural cycles in Earth’s climate… or caused by hundreds of years of human productivity, first taking effect during the industrial revolution via the unrelenting release of carbon dioxide and other gasses into the atmosphere as a result of the increasing capacity to modernize and reluctance to steer away from dependence on fossil fuels and the manufacturing techniques standardized across borders made worse at first by first-world countries exhausting their own resource supply and then by developing countries experiencing their own energy revolutions driving the consumption of non-renewables to previously unheard-of levels with little-to-no regard for the impact on the environment in an everlasting chase for market relevance in a global economy that rewards the inherent competitive advantage of scale… temps are on the rise and sea levels are going along with it.

That means it’s on you to exploit the Earth’s exploitation, and set your kids’ kids’ kids up for LIFE. This isn’t selling grandpa’s farm that he told you to hold on to, maybe get married there, maybe raise a family there, only to leave it in the hands of a developer to throw up a 431-home subdivision of 4 bed, 3 bath colonials in a suburb of Rochester, NY. No ma’am. That’s not at all a personal anecdote. Instead, we’re going beachfront property.

Worst case scenario, you’re looking at 10 feet of sea level rise heading into 2100+. Based on our lack of cumulative human ability to come together and legislate absolutely anything, I think that’s a safe bet. That puts a bullseye on the most-impacted locations across the country. Here are a few targets that are screaming BUY BUY BUY.

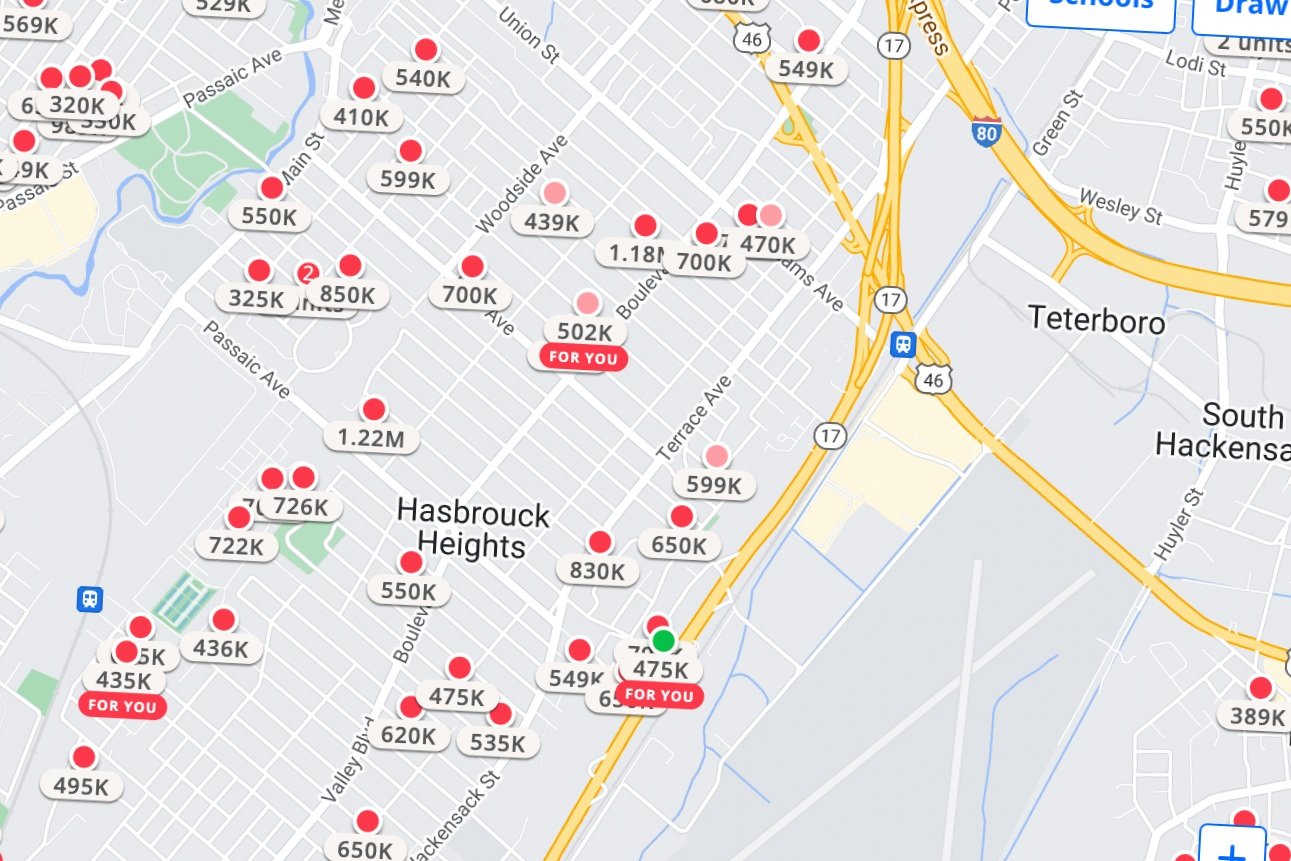

Ah, lovely metro New Jersey. Bergen county, baby, and we’re looking just west of the doomed Teterboro airport and Rt. 17.

I have my eye on this gorgeous 4/2 cape cod for $475k on Field Ave. A small price to pay for the teardown and subsequent beachfront bungalow Brett VI is gonna put up there.

Love the bones. A few years of TLC and good ol mother nature and here’s what we’re looking at. All those folks closer to the city are gonna have to move somewhere and they could do a hell of a lot worse than beach life in Hasbrouck Heights. Sure you might see the dilapidated skyline of a flooded manhattan out your front door but I think “barely-interrupted view of the sunrise”. $5.1MM easy. 974% return. Hot start.

But maybe New York/New Jersey isn’t your cup of tea. No problem. Let’s move to Florida where the map is so jarring that they won’t even let NOAA complete it because it’s basically just the Atlantic Ocean. Like, Miami is underwater by 50 miles?

Aruba, Jamaica, ooooh I wanna take ya

To Bermuda, Bahama, a suburb east of Naples. Take a look

I’m practically salivating. $465k for a 3/2 just off I-75 for a future oceanfront sunset view, are you kidding me?

Unclear if it comes with the Kia in the driveway that is suspiciously located a foot off the concrete. Given the fact that there’s a non-zero chance someone backed into this spot on meth while wrestling an alligator, I’ll absolutely commend them for their performance. Could’ve been MUCH worse.

Like the ancient Hawaiians used to say - when you’re itching for the waves, the only lotion is the ocean. And what may look like an out-of-date craftsman just became a beachfront bungalow ready for a couple patio beers or whatever spiked beverage they’re sipping in 2144.

But maybe you want a bit more French colonial history when it comes to homeownership. No problem - look no further than New New Orleans, formerly known as Baton Rouge.

You could argue that New Orleans is a better spot to look at property and I get it. In the screenshot above it’s depicted as an island saved by an intricate system of levees developed in the years after Hurricane Katrina. And maybe it stays protected and becomes an island of degeneracy in international waters ripe for bachelor parties, inhabited by former Saints fans, and surrounded by concrete walls keeping millions of gallons of water from crashing in on the folks below. But I wouldn’t call it paradise.

So we’ll look a little north.

How about that little minx outside of Westover, LA? It’s gonna set you back a bit at $3.4MM but where else are you going to find 40+ ACRES of (future) beachfront property next to a major population center relatively untouched by the rising tides and a haven for fleeing citizens from the south. Frankly I wouldn’t even be showing you this property if it wasn’t for the price tag being a little out of my range.

It doesn’t look like much on the surface, but 100-something years from now that’s New New Orleans’ premier beachside 5-star 9-hole executive golf community called something reminiscent of a boutique hedge fund like Woodsong or Pelican Head.

Think of the surf and turf specials.

“Brett”, you’re thinking. “All of these are great, but what if I want a little Pacific Ocean in my life? California dreaming. West coast lifestyle!”

We can work with that, but because of the inherent geologic advantage the west coast boasts with the pacific plate subducting under the north american plate due to the differences in the density of their respective crust over millions of years resulting in deeper ocean depths closer to the coast and orogenies like the one that built the Sierra Nevadas, the shoreline is less at risk with sea level rise. Tsunamis and earthquakes, sure. But no sweat on water.

You could look at the Santa Monica area, but that’s basically beachfront already and the ROI is limited. If we take it up the coast a bit, we’re in business. Napa?

Another one that’s gonna cost you in the near-term, but in the words of YG in the seminal classic, Scared Money ft. J-Cole & Moneybagg Yo, “scared money don’t make no money (woah). Pussy, we ballin on you fuckin dummies (uh-oh)”.

I added the second part for emphasis, but the point remains. 17+ acres in Napa ain’t cheap at $3.9MM but it’s peanuts compared to the beachfront VINEYARD your great great great granddaughter will sip sparkling rosé from while posting on whatever 3rd generation apocalyptic social media platform replaces Instagram.

Between the utility as a wedding venue, the early 2000s rom-com worthy setting for weary travelers, and the potential to make a damn good cab, you’re looking at setting your future dickhead kids up for decades-long financial freedom in a state that should only be taking 84% of your income at that point. It’s about the experience, y’all.

And there are so many more examples of potentially devastated coastline to look at! Get in now before it’s too late! Just because you won’t be able to enjoy the fruits of your investments doesn’t mean that you should deny your future in-laws the opportunity!

To help you take all this in and set your family up for a fortuitous financial future, I’ve developed a proprietary acronym that gives you everything you need to know. BALLS.

BORROW far more than you think you can afford. The cheap money spigot is still on for the time being and if you can basically prove that you’ve paid your phone bill on time for a year or two and have a job that’s not dependent on the financial stability of Eastern Europe, you’ll be able to find someone willing to loan to you. Just tell them this plan and they’ll make it work (read: sell your debt to the next person).

ANALYZE your opportunities. Like I mentioned above, the eastern seaboard and gulf coast is absolutely fucked if/when shit really hits the fan. Not only are inland opportunities more plentiful there, there are more coastal elites who will be forced to move from their ivory towers to the next spot to avoid the floods. Hot market. Careful, however, as this also means more folks like you looking to capitalize on such an opportunity.

LEVERAGE your assets against each other, using properties bought on borrowed money as collateral when you’re purchasing more. If they don’t allow something like this, they just don’t see the vision, man.

LEAVE your assets in a trust. When you inevitably die before sea levels hit their desired target activating the “beachfront” adjectives in your future Zillow descriptions, you won’t want your moron offspring to sell before the fruit is ripe. Build in a clause that only allows assets to be touched after a certain date, or an agreement to not be touched until a sea level is reached that signals a buying opportunity for someone else. It’s also a great way to avoid estate taxes if you play your cards right.

SPEND your time and money on the important things, like purchasing more property and renting your new homes and land out for a fraction of your mortgage costs. Don’t worry, you can write off losses or something. You can’t take it with you, after all.

Feel free to forward this one around the office - maybe to your newly retired boss who’s looking for a hobby outside flirting with cart girls and flying to Singapore on the weekends. And if you see any buying opportunities feel free to send them my way - I’ve developed a fund (well a fund of basketed super high interest rate mortgages that guarantee a crazy return on subdivisions in Ocala, FL) that allows me to deploy capital relatively immediately.

You can even name our LLC if you pay for it. Good luck.